Getting a business bank account is a wise decision if you want to join the estimated 33.2 million small businesses that are already functioning in the United States and are getting ready to launch your venture. Combining your personal and business finances might have negative effects on security, liability, compliance, and other matters. Separating them […]

Banking

What Is the Process of Processing an Electronic Check?

These days, few people pay with cash or written checks. These days, a lot of people use eCheck processing to do most of their financial transactions online. These checks are another modern way to move funds across bank accounts. An electronic check (eCheck) is a convenient way to pay a debt to another individual or […]

Getting a Business Line of Credit: What You Need to Know

A business line of credit can help the 33.2 million small businesses in the US with a variety of operating and expansion expenses. A revolving line of credit that only charges interest on the amount borrowed at any one moment makes it more flexible than a standard company loan. Finding out if you qualify is […]

Methods to Save Hundreds of Dollars with Online Banking

Debt payment is a chore that nobody enjoys. Making ends meet can be a genuine challenge for many families when they sit down to conduct their monthly budgeting. Trying to stretch your budget to cover everything could leave you feeling overwhelmed before it’s even over. Imagine if I told you there were easy ways to […]

Reasons to Pay for Subscriptions using Virtual Cards

Consider using virtual cards as your primary payment method if you have subscriptions to services like Uber Eats and Netflix or if you frequently sign up for free trials that require a credit card entry. You can avoid having your real card number compromised by using virtual credit cards, which, in contrast to physical cards, […]

Here Are Four Good Reasons to Open a Business Bank Account

To establish your firm and join the estimated 33.2 million small businesses operating in the United, opening a business bank account is a wise decision. Mixing your personal and business funds raises concerns about security, liability, compliance, and other areas. Separating them can simplify the financial side of running your business. Let’s take a closer […]

How to Avoid These 10 Common Bank Charges and Fees

When it comes to managing and protecting your wealth, banking is an excellent (and nearly essential) option. It costs money, though. Major banks’ most popular checking and savings accounts charge a plethora of fees. A monthly service cost is one example of an inevitable one. Some, such as insufficient funds or overdraft fees, only become […]

Tips for Taking Care of Your Bank Account Online

In many ways, technology has simplified our lives, and one of those is easier banking. You can now handle your banking needs online, which used to necessitate a large check register and monthly paper statement. You’d be shocked at how simple it is to use online banking if you’re on the fence about it. After […]

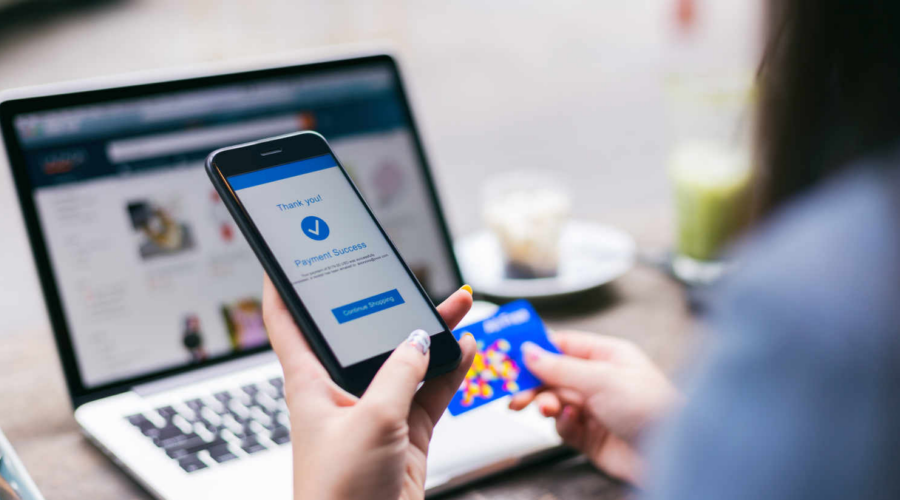

All the Information You Need About Mobile Banking

With mobile banking, you can see your bank statements and make transfers from any location. It might be as easy as checking account balances and bills, transferring funds, or buying prepaid services, or as complicated as reporting fraud or investing in stocks. To facilitate these activities, your bank may have built an app specifically for […]

Why Home Improvement Loans Are Beneficial

Most homes in the US could use some upgrades or modifications, as 92% of existing homes were built before 2000. Renovating one’s home, whether it’s a little touch-up or a whole gut job, is something that 91% of homeowners believe is necessary. A lot of people look at home improvement loans as a way to […]